Discretionary Multi-Strats

Robin Capital Group, Registered Investment Advisor, manages discretionary strategies through Separately Managed Accounts (SMA’s) utilizing preferred Executing and Clearing Brokers.

Strategy Descriptions:

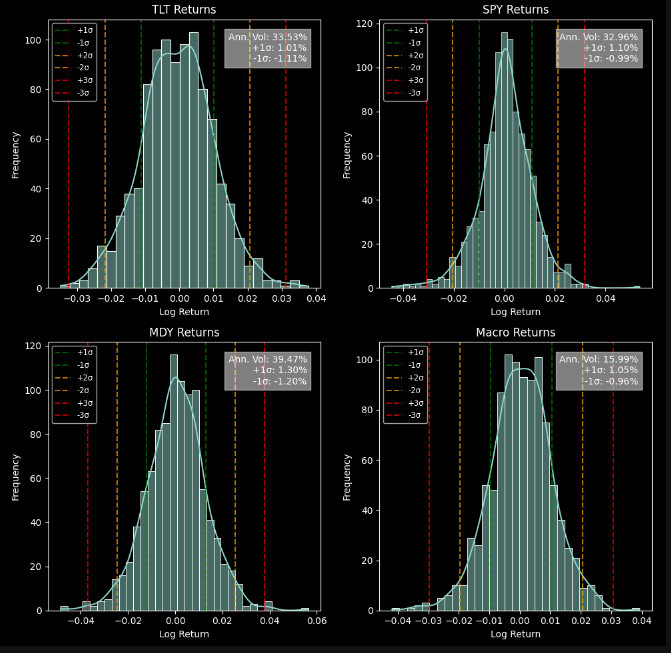

- Safe Haven: The Safe Haven Strategy is designed to offer stability and capital preservation through investments primarily in U.S. government and corporate debt, as well as related exchange-traded funds (ETFs). This strategy targets risk-averse investors seeking steady returns with minimal volatility. By focusing on high-quality bonds and ETFs, Safe Haven provides a reliable income stream while maintaining a low correlation to more volatile asset classes. The strategy’s conservative approach makes it an ideal choice for investors looking to safeguard their portfolios against market downturns.

- Dynamic Macro: The Dynamic Macro Strategy leverages global macroeconomic trends by investing in a diverse range of global ETFs. This strategy aims to identify and capture trends and momentum in short and long term time horizons. Dynamic Macro adapts to changing market conditions, allowing for tactical shifts in asset allocation as rate policy, seasonal, cyclical and correlation based signals present themselves across multiple models. This flexible, semi-sustematic approach seeks to deliver attractive risk-adjusted returns and is suitable for investors looking for active management within the global landscape.

- Inflection: The Inflection Strategy focuses on identifying pivotal market turning points within U.S. equities. By combining fundamental valuation analysis with quantitative techniques, this strategy aims to exploit significant shifts in market trends. Inflection seeks to generate alpha by positioning the portfolio to benefit from these inflection points, which may arise from economic changes, policy shifts, or valuations. Ideal for investors seeking dynamic exposure to U.S. equities, Inflection offers the potential for enhanced returns during periods of market transition and volatility.

A selection of strategies have been designed for the investment interests of retail and institutional clients with the goal of providing clients with access to alternative products in US based markets through professionally managed portfolios, thoughtfully designed at the discretion of their Portfolio Managers.

Three SMA strategies are currently available with Aggressive, Moderate and Conservative risk profiles ( Inflection, Dynamic Macro and Safe Haven)

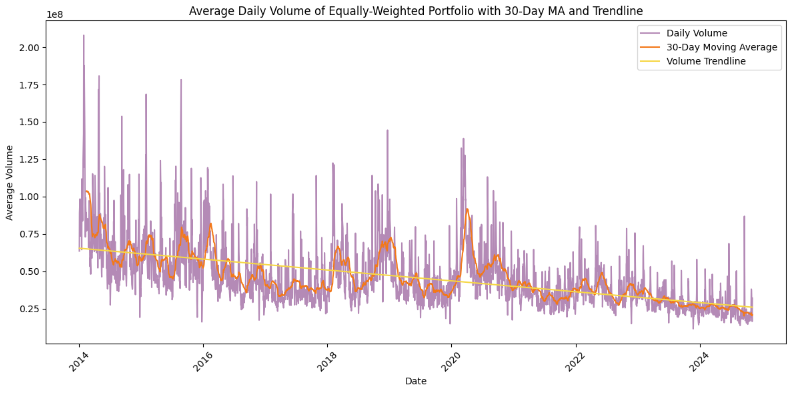

Our strategies routinely rebalance to profit take, reduce positions during market downturns and re-position at different stages of short, medium and long term cycles.

All Strategies have a live track record effective May 1 2022 (tear sheets available upon request).