- July 16, 2022

- Posted by: Nick Díaz

- Category: Uncategorized

Facts & Highlights:

1. From Milton Friedman’s monetarist theory: MV=PY (M=Money, P=Price Level, V=Velocity, Y=Output). With V & Y fixed, an increase in the stock of money will increase inflation (P) by the same amount.

2. Three types: Demand-Pull, Cost-Push and Built-In inflation.

3. Inflation is bad for currency, and normally good for tangible assets (including commodities and stocks).

4. The inflation measure is not exactly intuitive, bankers face credibility issues if policies steer away from target numbers.

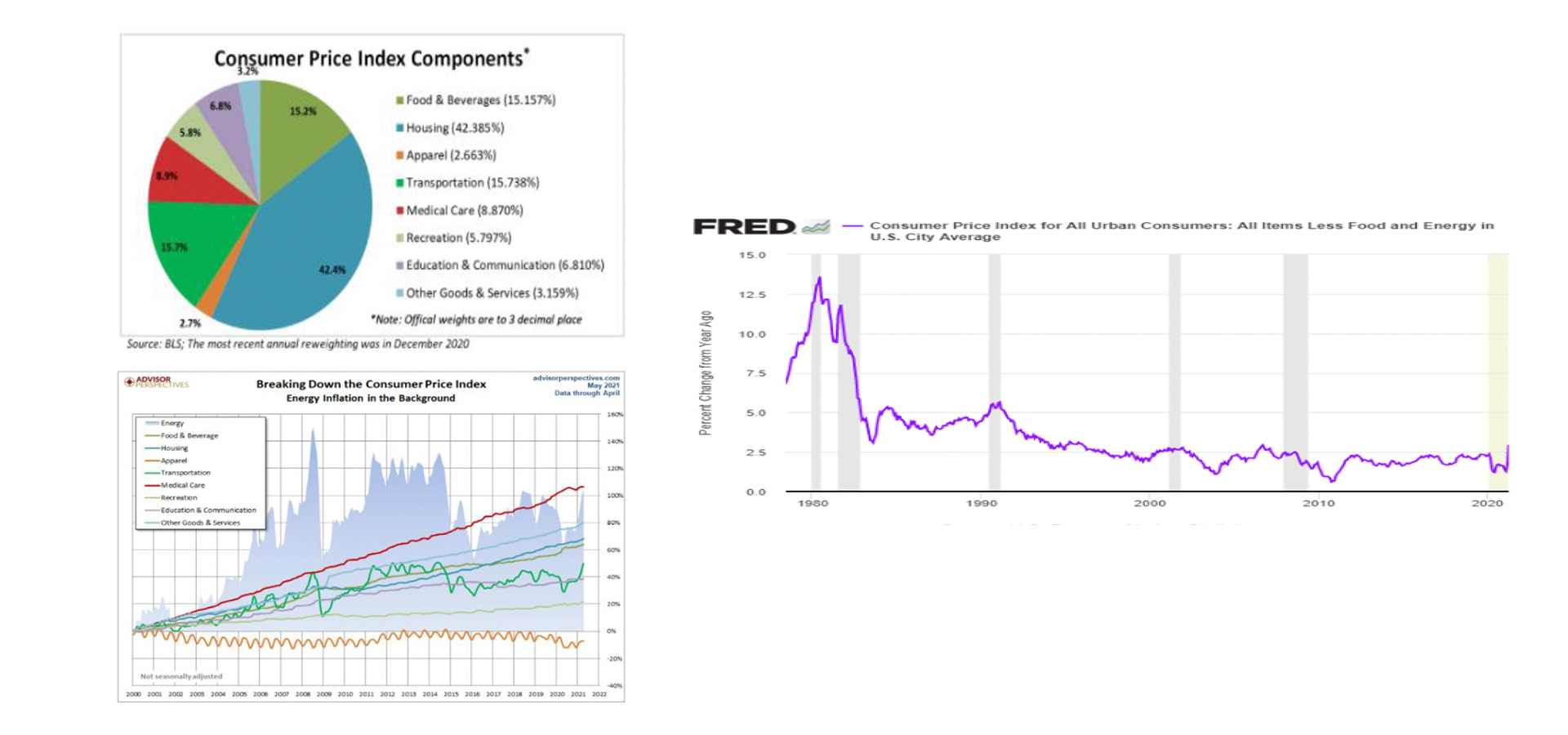

5. The deeper you drill into its calculation the more fungible a number it seems. For example, Energy is not a category of its own, it’s a subcategory within Housing and as Fuel in Transportation category (see graph below).

6. Low rates by the FED are supportive of economic growth which needs to exceed CPI. If GDP < inflation the US economy will be in a world of pain.

7. The past 40 years of historical data tell us that structural forces in the global economy are able to keep downward pressure on inflation.

[custom-twitter-feeds feed=1]