- April 21, 2021

- Posted by: Nick Díaz

- Category: Uncategorized

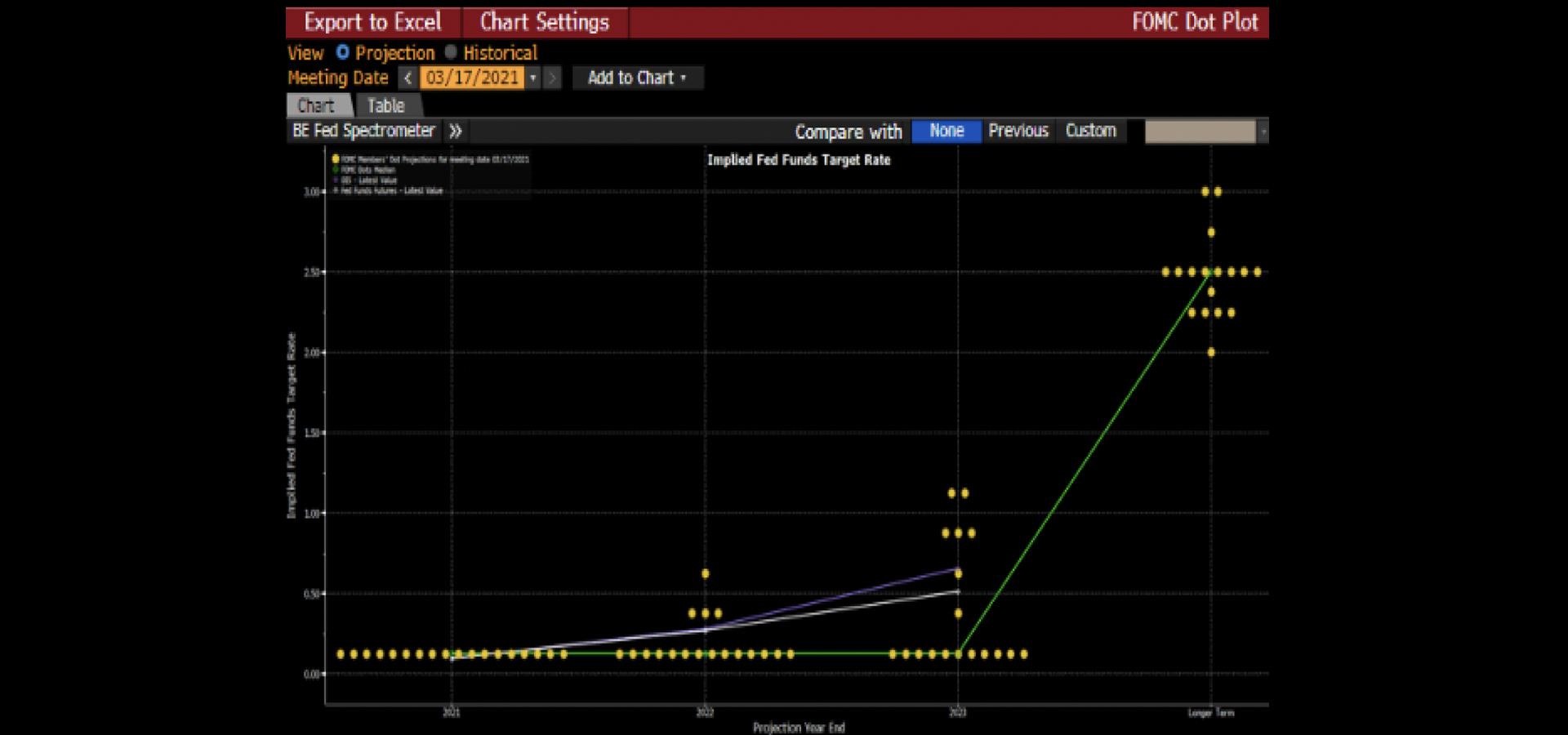

US capital markets remain on the path of least resistance and major indices continued to test new highs during April (S&P +5% for the month). The resiliency of risk assets continues to be strongly backed by a supportive Federal Reserve who reiterated their accommodative policy plans on last Wednesday’s FOMC meeting, guiding with near term disregard on inflation overshoots. Rates will remain lower for longer as the FED stepped in to buy the very front end of the curve against month end flows today (the Fed curve consolidating around 12/23 for next expected hike). The FEDs support coupled with slow but improving eco data, strong recently reported corporate earnings, healthy credit markets and global vaccination progress will likely keep a bid under risk assets in spite of the seemly high multiples and the choppy price action seen in the past few weeks. We turn to a broken global supply chain as we think of positioning for inflation and tactical sector allocations. We expect this to remain the bottleneck in the economic recovery and will continue to fuel higher prices in materials, food and beverages and transportation (our bigger drivers in the cpi basket). Hence, we favor exposure in commodity sensitive regions as well as global logistics companies, we remain sellers of current implied market volatility levels, keep our straddles on US rates markets and trade equities cautiously but from the long side into the upcoming summer months.

[custom-twitter-feeds feed=1]