- May 16, 2021

- Posted by: Nick Díaz

- Category: Uncategorized

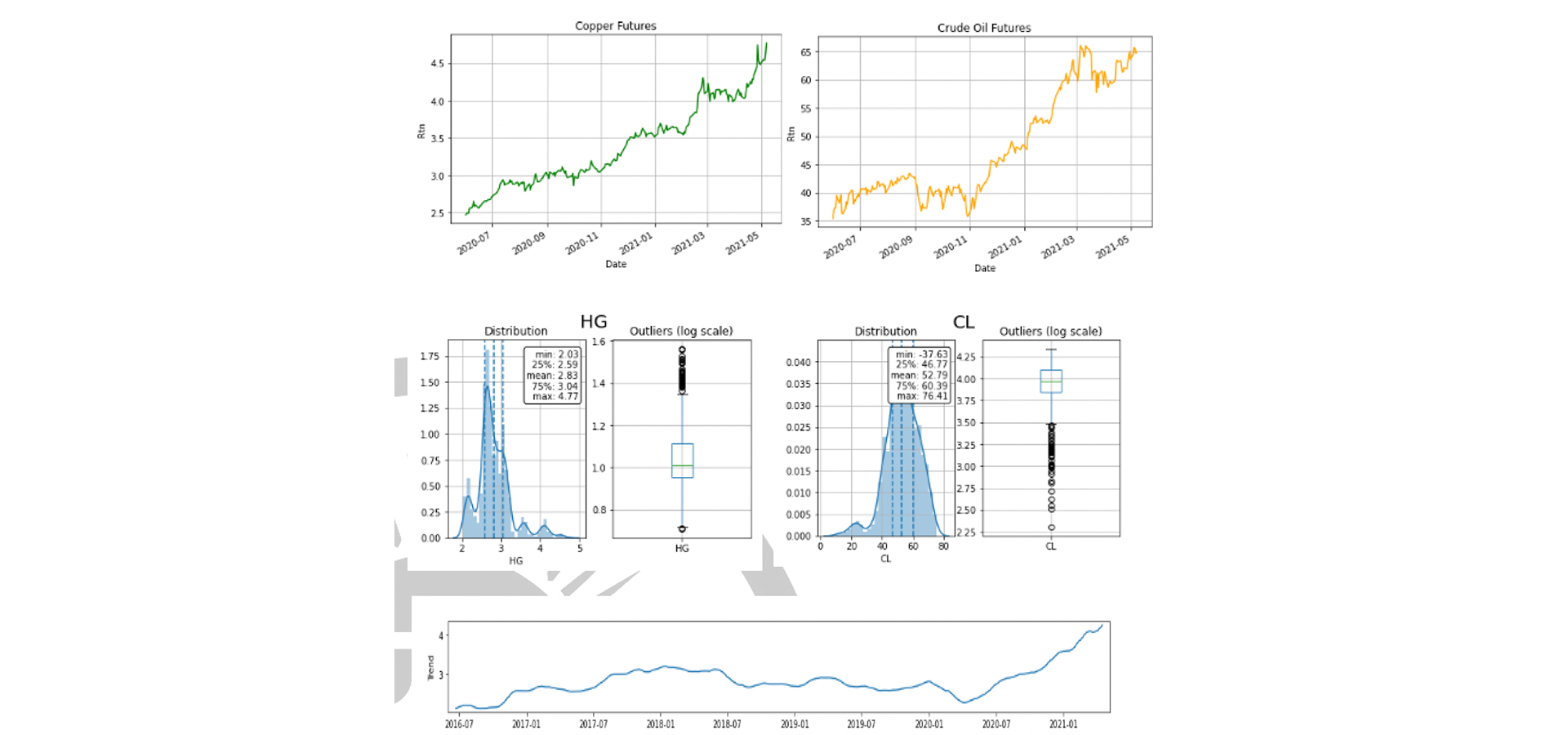

In spite of increased volatility, it was a relatively sideways week for equity markets which rapidly shifted after an outlier sized miss on Friday’s US payroll report (226k vs 1mm [Expected]). Easing any hawkish concerns investors had around the FEDs reaction function in response to the slew of positive economic data we have received over the past 4-6 weeks. The print quickly ignited a bull flattening move in 5s30s curve which subsequently led to a risk on rally across sectors. Materials and transportation related names outperformed during the week retesting prior highs and reconfirming trends within certain inflation pockets. We note copper futures (ticker:HG) could eek to $5.00lb near term as supply remains capped by the pandemic’s forces and global demand for the metal remains unsatiable. After today’s activity, we believe markets found sufficient strength (or lack thereof) in the payroll number to support the next leg higher, as much of the sidelined capital was comfortable getting back in the game this week. We expect the appetite for equities to re-emerge and further momentum to build. However, it’s worth noting that in order to maintain these “inflated” valuations, company performance will need to once again take precedent, we anticipate abrupt corrections for companies who fail to put up the numbers going forward, which may ultimately squeeze big names even higher.

[custom-twitter-feeds feed=1]